Web Applications: Financial Transaction Technology

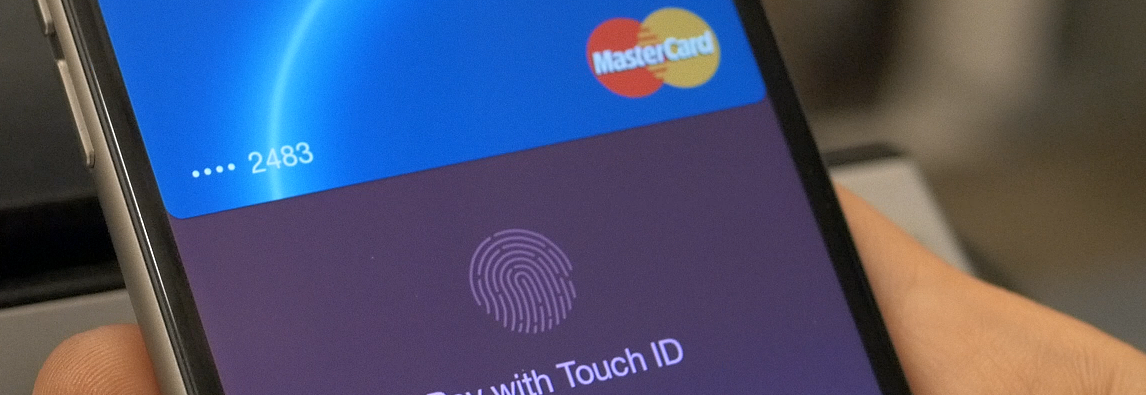

The future of financial transactions appears set to change for good, thanks to new mobile applications and ‘Near Field Communications’ technology (NFC).

Due to the increasing popularity of mobile and web applications, financial institutions have been investing in new payment systems specifically for mobile devices.

Earlier this year, Orange rolled out their ‘Quick Tap’ contactless payment device, which uses NFC, for payments up to £15. Recently, several more commercial giants across the world have announced their own movement into this transactional hotspot, and the imminent arrival of their new payment facilities using NFC technology.

Google have announced a new ‘Wallet’ app, which is designed to make payments easier for consumers. Meanwhile, the Commonwealth Bank in Australia has launched their ‘Ka-ching‘ app, which allows smart phone and iPhones to connect with cash registers and to make payments electronically. Payments are made by adding iCarte to the handset, which allows purchases up to $100 to be made by phone where MasterCard PayPass facilities are present.

Visa Europe launched two services this autumn to rival PayPal and Google. Their Mobile Person-to-Person service allows a registered user to transfer funds via a mobile phone to any Visa cardholder in Europe.

However, a recent poll of over 1,000 Britons by behaviour analysts Intersperience revealed that just 17% would consider using their mobile phones as a card payment device. 44% cited the lack of security software as their main concern, though the younger generation of respondents appear much less resistant.

It is going to be vital for confidence that all mobile and web application technology designed for financial transactions is designed to the highest calibre. Eurocal Group prides itself on quality innovation and engineering to ensure the very best results in all fields of digital technology.